Deferred Gift Annuity

As a younger donor still in high-earnings years, you are still saving for retirement and also trying to lower your taxable income.

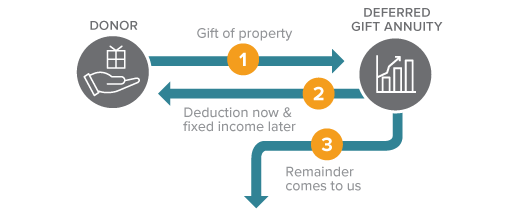

How It Works

- You transfer cash or securities to The FAMiLY Leader. Our minimum gift requirement is $10,000.

- Beginning on a specified date in the future, The FAMiLY Leader begins to pay you, or up to two annuitants you name, fixed annuity payments for life.

- Generally, deferred gift annuities may be created by donors of any age. However, a beneficiary must be at least 40 years of age before deferred gift annuity payments commence to the beneficiary.

- The remaining balance passes to The FAMiLY Leader when the contract ends.

Benefits

- Deferral of payments permits a higher annuity rate and generates a larger charitable deduction.

- You can schedule your annuity payments to begin when you need extra cash flow, such as retirement years.

- Payments are guaranteed and fixed, regardless of fluctuations in the market.

- The longer you elect to defer payments, the higher your payment will be.

Next

- More details on Deferred Gift Annuities.

- Frequently asked questions on Deferred Gift Annuities.

- Contact us so we can assist you through every step.