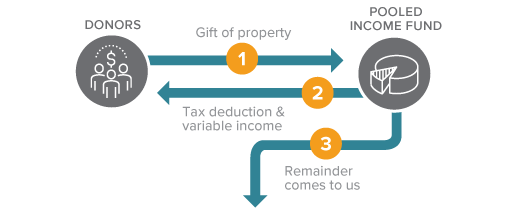

Pooled Income Fund

How It Works

- You transfer cash or securities to the Pooled Income Fund. Our suggested initial minimum gift requirement is $10,000.

- The fund issues you units, like a mutual fund, and pays you (or up to two income beneficiaries you name) the annual income attributable to your units for life.

- The principal attributed to your units passes to The FAMiLY Leader at the passing of the last income beneficiary.

Benefits

- Receive income for life in return for your gift.

- Receive an immediate income tax deduction for a portion of your gift to the fund.

- Pay no capital gains tax on any appreciated assets you donate.

- Income can exceed dividends you were receiving on the securities you donated.